Danish Telcos Form Joint Venture to Keep Control of NFC Revenue

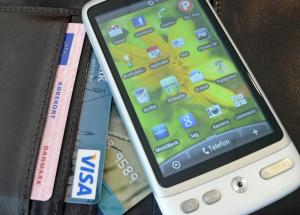

Denmark’s four mobile operators are the latest telcos to announce an NFC joint venture, seeking to roll out mobile wallets on their own terms.

The telcos, TDC, Telenor, TeliaSonera and 3 Denmark, today said they had formed the venture to put in place a common platform and possibly a common brand for their planned NFC mobile wallets.

The telcos would enable such services as payment, loyalty, ticketing and ID through the wallets, which will probably launch by the end of 2012, followed by larger rollouts in 2013, the telcos told NFC Times.

“It will be quicker for us to launch the services we want to launch, and it will be easier for consumers to use because there will be one standard,” Søren Abildgaard, CEO of TeliaSonera Denmark, told NFC Times.

Like the three largest mobile operators in the United Kingdom, Everything Everywhere, Telefónica UK and Vodafone UK, which announced a joint venture for NFC mobile wallet services last week, the Danish telcos are partnering to push a common NFC platform anchored by SIM cards they will issue.

The Google Threat

In both countries and in others, such as the United States and the Netherlands, competing mobile operators see partnerships as the best way to increase their clout as they try to keep control of the NFC phones they sell to subscribers and the revenue derived from NFC services.

“The threat stemming from non-SIM based wallets, such as Google has launched, (has increased) the sense of urgency,” Morten Hother Sørensen, vice president for business development at TDC, Denmark’s largest telco, told NFC Times. “Basically, there’s continuously a fear from the telco side to being reduced to a bit pipe.”

Google, which last month unveiled its NFC-based Google Wallet in the United States, said last week it planned to launch the wallet in Europe during the first half of 2012.

While the Danish telcos say they’ve been in discussions to form the joint venture since last year, they agree the likes of Google are increasing pressure on them to launch services.

“If you want to grab part of the market, you’ve got be part of the first movers,” Abildgaard said.

Just the same, he explained that the telcos would probably not launch NFC until late 2012 and would not roll out widely until at least 2013, in part because they want to wait for a broad selection of NFC-enabled smartphones to hit the market.

Until then, the telcos will work together on SMS-based payment services, which they already offer separately.

Taking a Slice of NFC Payments?

The telcos say their NFC platform will be open to all banks and other service providers, although they might decide to introduce their own payment applications. For that, the telcos or the joint venture would need an e-money or payment institution license from the government.

“That’s one of the things we’re looking at, prepaid wallets,” said Abildgaard. “Parents want to top up for their kids to buy food at school. Parents can (then) control the consumption of their kids.”

But he said the telcos might also try to collect a slice of payment-transaction revenue from banks that put their applications onto the NFC phones. “We’ll take our fair share,” Abildgaard said. And he added that the operators haven’t ruled out launching their own payment scheme and brand at the point of sale.

But not everyone agrees the operators could capture a share of bank-payment revenue, especially from debit transactions, which reportedly carry the lowest merchant transaction fees in Europe.

“I know for a fact they won’t allow us into the transaction,” said TDC’s Sørensen, speaking of banks and the dominant processor in Denmark, Nets, which is also an acquirer. But he added: “If we decide become issuers, then we could enter the transaction.”

SIM is Key to Business Model

The business model for the Danish telcos relies on the SIM as the primary secure element in the phones, Sørensen told NFC Times. The telcos plan to charge fees to service providers, such as banks, to put their applications onto the NFC-enabled SIMs the telcos issue and to manage the applications there, he said.

That includes downloading, updating and deleting the applications over the air. For that, the telcos will probably hire a single trusted service manager, or TSM, he said.

“Obviously, to get access to our clients, you have to pay for that, either a rental model or per transaction. It all depends on the service,” Sørensen said.

For certain services, the telcos might even charge fees to consumers, such as allowing the subscribers to put their driver’s licenses or health cards onto the NFC phones, he said.

There are still few contactless point-of-sale terminals in Denmark, but most conventional POS terminals are ready for the simple addition of contactless readers, Sørensen said. Also, transport authorities are rolling out a nationally interoperable contactless transit card scheme, making transit ticketing a natural service offered in the planned NFC wallets, he said.

The joint venture also will set requirements for NFC handsets–mainly that the phones support SIM-based applications using the standard single-wire-protocol connection between the SIMs and NFC chips.

Even by banding together, however, Denmark–with only about 7 million mobile subscribers in total–is too small to make a difference with the features handset makers put into their NFC phones.

In fact, many handset makers are ordering embedded secure elements in their NFC phones that might be out of the direct control of operators.

But TeliaSonera’s Abildgaard noted that telcos have the direct relationship with subscribers and they order most of the phones. Many are expected to support the single-wire protocol.

“Even Google and the Android platform, they know they are heavily reliant on operators,” Abildgaard told NFC Times. “We do subsidize their handsets in many, many markets around the world.”