Czech Bank ‘Issues’ NFC SIMs for First-Mover Advantage

NFC Times is Expanding Its Coverage

This story is a free sample of new premium content from NFC Times, the most authoritative source of news and analysis in the industry.

To view this sample story, click here:

Or download it as part of a free sample of the world’s first global PDF newsletter devoted to the business of NFC and related topics:

NFC Times: The Intelligence Report

Become a subscriber to NFC Times to receive future issues of the newsletter and exclusive online news and analysis:

Subscription Options

GE Money Bank in the Czech Republic refers to its launch of NFC services as SIM-centric, but it’s the bank, not partner Telefónica O2, that issues its customers NFC SIM cards.

Well, essentially the bank has served as the issuer. After launching its commercial service in January, customers have gone to its bank branches to sign up for the service, not the operator’s stores, and the bank then has mailed the SIM, personalized with the customer’s account information as part of a preloaded MasterCard PayPass application. The customers, who must be O2 subscribers, then have gone to the O2 shop with the new SIM to have it programmed with their phone numbers.

”It was our decision to drive the end user to the bank rather than the operator to change the SIM card for the NFC market,” said Ondrej Hájek project manager for the service for GE Money, speaking at a conference this spring. “So it really doesn’t matter at this point, if you have the over-the-air personalization and, anyway, we want to have the customer at our branch and not send them to the mobile operator.”

Of course, preloading the application and sending out personalized SIMs by mail was easier for the bank than having its trusted service manager set up its platform to provision the cards over the air, added Hájek. This enabled GE Money, the No. 3 bank by number of branches in the Czech Republic and which considers itself the country’s most innovative bank, to launch the service faster than competitors, he said.

“This was the fastest way to get the fully operational solution in the market,” he said.

The bank and O2, along with MasterCard, launched the service in January. GE Money plans to move to over-the-air downloads and provisioning of its payment applications in phase II of the project, although Hájek in March couldn’t say when that would start.

When it does, the bank would be able to distribute more than one payment card, such as debit and credit, to the same SIM. GE Money has used Giesecke & Devrient as its TSM and so does O2, which he said would help with the launch of the second phase. “We do not want to confuse them (consumers) in terms of payment, he said. “(It) will remain with SIM-centric solution, all payment will remain online and PIN on POS.”

The bank also plans to integrate with other operators, but appears to be planning to drive awareness of NFC with O2, which has been the most active of the operators in the Czech Republic. In response to a question, Hájek said O2 is not charging any fees to GE Money to put its application on its SIMs, and the bank isn’t charging O2 if any users decide to switch operators to O2 just to use NFC.

“We agreed with O2 that this is a first step in order to build the NFC ecosystem and NFC environment in the Czech Republic, so currently we don’t pay anything to O2 and O2 doesn’t pay anything to us. This is a mutual project, where we want to educate the people and we want to provide the NFC solution to them.”

With the second phase, the bank will continue to require customers to enter their PIN in the point-of-sale terminal for all transactions above CZK 500 (US$25.30).

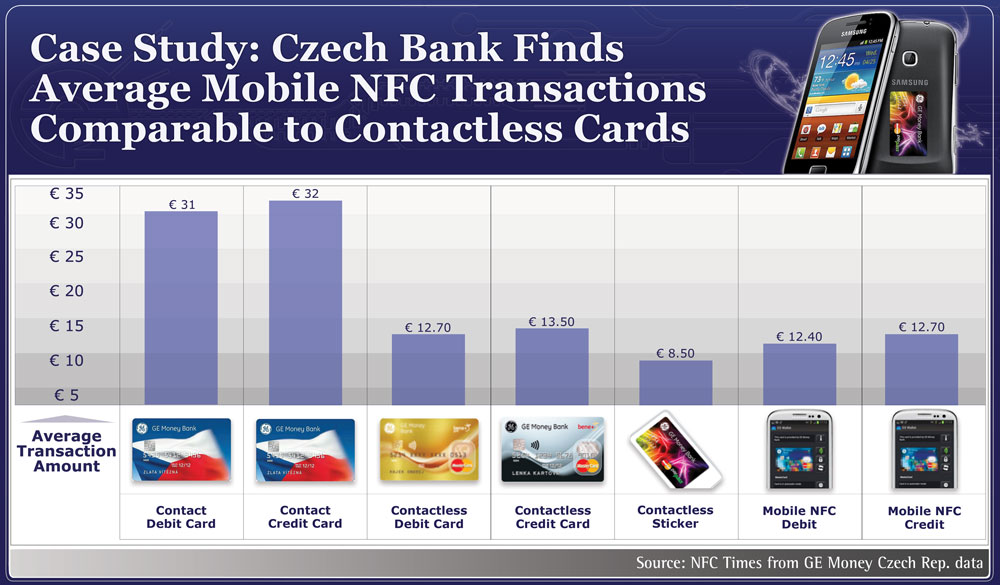

GE Money began issuing passive contactless stickers in addition to launching SIM-based NFC in January. In the first two months following the launch, Hájek noted that the average transaction amount for stickers was only €8.50 (US$11.08), well below that of mobile NFC, at €12.40.

GE Money began issuing passive contactless stickers in addition to launching SIM-based NFC in January. In the first two months following the launch, Hájek noted that the average transaction amount for stickers was only €8.50 (US$11.08), well below that of mobile NFC, at €12.40.

”Mobile NFC average transactions rise to the same value as the case of the contactless cards, which might signal to us the mobile NFC is perceived as the equivalent of contactless cards and a much more robust solution than in the case of the stickers,” Hájek said of the launch results after two months. “So whether the stickers are perceived for the low-value payments, the mobile NFC is really perceived as something that can serve as a standard payment (tool), which is really an important message to us.”

GE Money has also been a leader in the Czech Republic in rolling out contactless cards, with 140,000 issued as of March, representing 15% of its debit card portfolio and 7% of credit cards. There were about 15,000 contactless point-of-sale terminals active in the country, nearly 13% of the installed base of terminals.

Hájek said contactless transactions were accounting for 10% of total card transactions among its customers. Average transaction size with contact transactions, at €31.50, remained much higher than contactless.