One or more issuers are privately complaining about fees that the Isis joint venture is seeking to charge to host their payment applications in the Isis Wallet, NFC Times has learned.

The fees are about $5 per consumer account per year, sources told NFC Times. That is much more expensive than issuing plastic cards, note the sources.

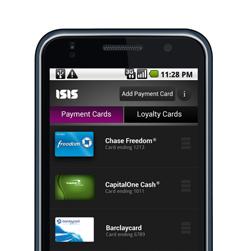

Four banks or credit card companies have announced they plan to make their payment applications available for the Isis Wallet starting with trials in Salt Lake City, Utah, and Austin, Texas, planned for this summer: JPMorgan Chase, Capital One, Barclaycard US and American Express.

The thing to remember is the actual cost of plastic cards is far greater than just the plastic. With embossing, personalization and mailing it all adds up. How many of us have actually had a card expire in their wallet. With fraud and security breeches I seldom have a card in my wallet for more than 12 months. Issuing a new cards retains all the back end costs. From the article it sounds like replacing credentials in the wallet will be far cheaper. Plus the move to EMV is not going to make issuing cards any cheaper for the issuers. If Isis will continue the $5 pricing for contactless EMV the issuers could end up saving money over a plastic chip card.