Google Unveils Its NFC Wallet, Seeking ‘New Era of Commerce’

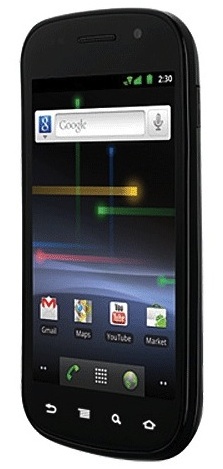

Google has unveiled its NFC Google Wallet, which the Web giant hopes will usher in a "new era of commerce," using its Nexus S handset and, later, other Android NFC devices.

Google, in its announcement today with such partners as Citigroup and MasterCard Worldwide, said consumers will be able to tap to pay with a Citi PayPass payment card account, gift card account, as well as redeeming promotions and earning loyalty points—“all with a single tap of their Google Wallet.”

The company announced several retail chains that will participate in the planned U.S. commercial launch this summer, including some that do not now accept contactless card payment. Google is reportedly subsidizing the contactless point-of-sale terminals for the merchants. Google said it is working with terminal and reader vendors VeriFone, Hypercom, Ingenico and Vivotech.

The merchants include such large chains as Subway sandwich shops, retail pharmacy outlets Walgreens and Duane Reade, toy store Toys “R” Us, clothing merchants American Eagle Outfitters, Foot Locker and Guess, department stores Macy’s and Bloomingdale’s, and electronics store RadioShack. That is in addition to the more than 100,000 merchant locations in the United States that already accept PayPass cards and, therefore, could accept PayPass applications on the Google phones.

“E-commerce is still only 8% of total retail,” said Stephanie Tilenius, vice president of commerce at Google, in a press conference today. “This means 92% happens in the physical world. With smartphones, geo-location and NFC technology, we're about to embark on a new era of commerce, where we bring online and offline together.”

Update: Following the Google Wallet launch, online payments company PayPal filed suit accusing Google of stealing its trade secrets by recruiting former PayPal executive Osama Bedier, who is Google's head of payments. Bedier helped Tilenius demonstrate the wallet during its launch in New York. The suit also names Tilenius, who previously worked at PayPal's parent, eBay. End update.

Besides Citi and MasterCard, other partners involved in the launch include First Data, the largest transaction processor in the United States, which also will serve as trusted service manager to deliver and manage payment applications over the air to the embedded secure chip in the Nexus S, as NFC Times reported earlier.

And Google also introduced a service called “Google Offers,” which will send promotions to the inboxes of users' phones, tied to particular merchants or businesses. Consumers could also search for offers through apps. These could be “deal-of-the-day” offers, thus competing with Groupon and similar Web-based services. Google Offers likely is central to the company's strategy for NFC.

Google said it is launching trials of Google Wallet in New York City and San Francisco and plans call for a roll out in these and other cities to begin in the summer. Google Offers would go live this summer in New York, San Francisco and Portland, Ore.

“I think it is game changing from a customer experience point of view,” Joe Magnacca, head of daily living products and solutions for Walgreens, the largest U.S. drugstore chain, said in a promotional video from Google. “If you think about a customer walking into a store, they now have information at their fingertips, value at their fingertips. Things that didn’t exist before.”

Limited Handsets at Launch

The Google Wallet app appears to be limited, at least for now, to Nexus S 4G phones sold for customers of No. 3 U.S. mobile carrier Sprint, not the 3G version put on the market earlier for T-Mobile USA customers, or other Android phones. This could significantly limit the number of devices that could carry the wallet.

Sprint is a partner in the project, and there might be a period of exclusivity before the 3G Nexus S is available with the wallet, downloaded by First Data and its technology partner SK C&C.

A source told NFC Times Google hopes to have 500,000 of the Nexus S phones activated by the end of the year. Google did not mention a target for handset distribution and declined to reveal how many users would be involved in the trials.

A source told NFC Times Google hopes to have 500,000 of the Nexus S phones activated by the end of the year. Google did not mention a target for handset distribution and declined to reveal how many users would be involved in the trials.

Steve Owen, vice president of sales and marketing for the identification unit of NXP Semiconductors, supplier of the NFC chip and embedded secure element for the Nexus S, told NFC Times that all Android phones and also Android tablet computers could potentially support the wallet in the future. The latest versions of Android for phones, 2.3, known as Gingerbread; and Android 3.0, nicknamed Honeycomb, for tablets, support NFC, he said. So if device makers incorporate NXP’s PN65 NFC chip and embedded secure element, it could support the wallet.

Google would only say that the wallet will be available first on the Nexus S 4G, and "additional devices with NFC capabilities will follow."

'Astute Move'

Google said today in its announcement that at commercial launch, its wallet will support both a Citi payment application and a separate “virtual Google prepaid card,” which will also support PayPass. Users will be able to top up the card with any of their payment cards. Google is offering a $10 activation bonus. The prepaid program is expected to be managed by First Data.

In response to a question at the press conference today, Google said it did not plan to charge transaction fees from merchants for payment, though that might refer to the Citi application.

Google instead plans to make its money with targeted advertising and offers. The Web giant hopes to cash in on the move to mobile for Web search and shopping by consumers, using NFC interactivity and other data it collects on shoppers’ locations, buying habits and preferences.

“Of course, this is opt-in, you don't have to provide your location or other info if you don't want to,” said Tilenius. Google added it will not be collecting users' financial data or history of purchases.

Analyst Nick Holland of U.S.-based research firm Yankee Group, in a short commentary and report timed for the Google announcement, said that the initiative is an “astute move,” in which the company could replicate its lucrative Web advertising model that accounts for 97% of its revenue, and do it in the physical world. This offers some bonuses.

“In short, Google now has the capability to own location-based advertising with a level of granularity pertaining to consumer behavior that will be virtually impossible for anyone else to replicate,” Holland said, adding:

“Is it that big of an announcement? Yes and no. This will be a slow incremental value add for the consumer, limited by the number of mobile devices with NFC capabilities and the initial low level of merchant locations equipped with reciprocal reading devices.”

But he said the initiative signals the start of the “next generation of consumer interactivity.”

NXP's Owen said Google's recruitment of new merchants to accept contactless could encourage many others to move on the technology and install terminals. At present, fewer than 3% of card-accepting merchants in the United States take contactless. "People will see it happening, and they believe in first movers," he said.

Google has been working for a number of months on the mobile wallet along with mobile-commerce applications for its Android operating system, NFC Times reported in January. NXP worked with Google on security for the wallet and is also a partner in the launch.

The project launch has been delayed several times, however. It had originally been scheduled to be announced earlier this year, said sources.

Google Controls the Chip

Google today also confirmed that it would put the secure applications on the secure chip in the Nexus S, a chip it will control. Google could try to control embedded chips and application-programming interfaces, or APIs, in other NFC phones, as well, which could put it at odds with mobile operators that want to control the application-bearing chips in NFC phones they sell.

That could become a bone of contention for mobile operators in the Isis joint venture, made up of AT&T, Verizon Wireless and T-Mobile USA, an Isis representative earlier told NFC Times. Isis wants to control the secure elements in its members' NFC phones. Sprint had been involved in the planning of the joint venture, but dropped out.

European operators also are looking on with concern, since their business model for NFC is based on charging fees to banks and other service providers to put their NFC applications on SIM cards that the telcos issue.

“They’re going to do this (only) in the U.S.,” Anne Bouverot, executive vice president for mobile services for Orange Group, told NFC Times today, before the Google announcement.

But Google, in fact, is also seeking to recruit European banks to be part of the mobile-wallet initiative. While the Nexus S also supports the single-wire protocol connection to the SIM card, it's possible that Google could block this.

“(In that case), we cannot do troubleshooting or customer support,” said Bouverot, speaking of the prospect for applications to be stored on embedded chips in NFC phones. “Customers expect when they have a problem paying with their phone, they will call their operators.”

Update: It's possible Google could control the secure elements in Android phones other than its own Nexus S model–even if it doesn't control the keys to the chips, which likely would be owned by the handset makers or mobile operators buying the handsets, said Hans Reisgies, executive vice president for business development at U.S.-based Sequent Software, a specialized trusted service manager. “Are they going to use Andorid API availability to prohibit other wallet service providers? That’s the fundmental question that was not answered in the (Google) briefing. Can the Isis wallet use the secure element on NFC android phones?” End update.

Google made a point of saying that the wallet would be open to other banks and service providers, along with other mobile carriers and handset makers. It remains to be seen how this plays out. Google is likely to want to control which applications go into its wallet, so it would probably want those applications on embedded chips in Android phones, for which it could control the APIs and master keys, managed by First Data.

Clipping Digital Coupons

To reassure consumers about security, Google said the wallet will require an “app-specific PIN” to activate, and in the first release, “all payment card credentials will be encrypted and stored on a chip.”

As for offers, Google said consumers will be able to search on their phones then “clip” digital coupons and load them into their wallets. For merchants not yet equipped with contactless terminals, consumers can show the coupons to merchants on their phone screens. Google Offers appears to be an even more targeted service.

The company said it has tested such consumer deals as offering a 20% discount on a pair of boots that consumers could find in a Google search advertisement. Or they might get $5 off for checking in upon entering a store, presumably by tapping their phones on NFC tags.

“Whenever you buy or save an offer, you will be able to automatically sync it to Google Wallet,” said the company in the press announcement, adding that, later, users could put receipts, boarding passes and tickets into the wallet.

“Eventually, you'll be able to put everything in your Google Wallet,” said Tilenius.

Automatically sync to google wallet on bying is new feature to it, i like it the most. It has came with great enhancement. It will take control over markets i guess read it http://t.co/6KOftiV

You will learn what type of turmoil it has made among other companies wallet.