Did Low-Cost HCE Project in Taiwan Get a Low-Cost Vendor?

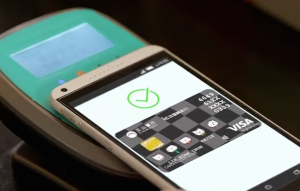

NFC Times Excusive – When Taiwan’s No. 3 credit card issuer, E.Sun Commercial Bank, held a press conference with Visa Dec. 28 to announce it was the first bank on the island nation to launch HCE-based mobile payments commercially, it also presented Hewlett Packard Enterprise as its technology supplier for the project.

At the time, HP confirmed to NFC Times that it had hired Giesecke & Devrient to provide the HCE technology. But NFC Times has learned that G&D, in turn, hired what is believed to be a Singapore-based subcontractor to do most of the work on what sources say was a very low-cost project.

HP, G&D and the subcontractor itself, which is believed to be Aptus Business Logic of Singapore, declined to confirm that Aptus worked on the project.

But sources say the Singaporean vendor, which is Visa certified, was able to provide low-cost HCE technology for what is believed to be a rock-bottom price that likely could not have been provided by the other vendors–at least not at such a low price and on the tight time schedule that E.Sun demanded.

If so, the project could have implications for other HCE implementations, where both money and time is limited.

HP Enterprise in Taiwan, the main contractor on the project, did not return messages for comment. Germany-based G&D declined to say whether it hired its own HCE subcontractor, responding to NFC Times that it has a policy against commenting about customers. And Aptus would not confirm it is working on the E.Sun project.

A spokesman for the bank itself told NFC Times that its contract was only with HP and G&D, and it did not contract with any other company. If G&D did not, in fact, use its own HCE technology for the project, it probably offered oversight.

G&D is heavily promoting its own HCE technology in the market, which it calls its Convego CloudPay solution. It consists mainly of HCE-enabled app software and a credentials management system on the server side. The latter generates and manages limited-use keys for the applications and loads them into the HCE app along with tokens. G&D, which is also Visa certified, does personalization for mobile payments services, as well.

Since E.Sun is issuing alternate card numbers, or alternate PANs, instead of supporting EMVCo-specified tokenization in its HCE wallet app, G&D could supply this part of the project, as well.

That is why it would be unusual for G&D not to have provided the technology itself for the bank’s E.Sun Wallet launch in Taiwan.

Low-Cost Market

But Taiwan is not like most other developed markets. Taiwanese consumers are tech savvy and have among the highest use rates of smartphones globally, making the country a promising market for launching NFC mobile payments. But Taiwan is a decidedly low-cost market.

For example, a joint venture, Digital Alliance Technology Co., led by Taiwanese telcos hired France-based Safran Morpho in late 2013 or early 2014 to build secure element and service provider TSM platforms for what is believed to be only around NT$50 million (US$1.6 million).

A competing joint venture formed by banks and banking groups, Taiwan Mobile Payment Co., is also believed to have paid a low price when it hired U.S.-based Mozido last year to provide an HCE and tokenization platform. Mozido is believed to be using technology from South Korea-based SK C&C for the job. Sources place the contract at only around US$2 million, a price neither Taiwan Mobile Payment nor Mozido would confirm.

This new platform is meant to serve at least 30 banks and includes tokenization complying with EMVCo specifications.

But while E.Sun is one of the many banks that are part of Taiwan Mobile Payment joint venture, it sees itself as the most innovative bank in Taiwan. So it wanted to beat the JV to launch the first HCE project on the island.

That meant launching before the end of 2015, since Taiwan Mobile Payment was planning a pilot of HCE with at least three banks, including E.Sun’s two larger credit card issuing rivals, Chinatrust Commercial Bank and Cathay United Bank.

Not only did E.Sun want to beat the joint venture to a launch, it wanted to do so with is believed to be an extremely low budget, what some are estimating to be in the US$100,000 or $200,000 range.

The bank would not confirm the budget to NFC Times. It did say it first hired its main technology partner, which would be HP Enterprise Taiwan, in July. HP would have hired G&D, but the vendors are not believed to have started work until around September. They would have faced a deadline of only around two or perhaps three months.

Aptus Business Logic, which refers to itself as ABL, has offered “electronic payment solutions” for 15 years, used by banks, merchants and payments processors, according to its Web site. The company says it works with “multinational technology companies, as well as local systems integrators to provide comprehensive pre- and post-implementation support.”

According to the Visa Ready Program for Cloud-based Payments directory, Aptus is approved by Visa to supply HCE-enabled app software. It also is believed to be approved for one or more server components for HCE. The company says it built its HCE technology in-house.

The company is also believed to be approved by China’s Bank Card Test Center, or BCTC, to supply HCE technology for Chinese banks implementing the Quick Pass application from China UnionPay. It’s not clear whether the firm is providing HCE technology in China yet.

Aptus is not believed to be certified yet by MasterCard.

Visa Contributes Resources

That fact, however, probably does not explain why E.Sun launched its HCE wallet app and allowed customers only to load their Visa-branded cards, not those branded MasterCard, despite the fact that around three-quarters of E.Sun’s nearly 4 million credit cards bear the MasterCard logo.

As NFC Times reported at the time of the December launch, E.Sun representatives asked by NFC Times, including bank president Joseph Huang, would not say specifically why they launched HCE with Visa and not MasterCard. Besides the predominance of MasterCard-branded cards in the bank’s portfolio, E.Sun had worked with MasterCard on all previous NFC mobile-payments projects, most of them pilots.

Visa, which has long played second fiddle to MasterCard in supporting mobile payments in Taiwan, probably offered a better deal to E.Sun in terms of putting up money for marketing and promotional support for the launch. That includes paying all or at least part of the expenses for a press conference held in a five-star hotel in Taipei in December to unveil the new E.Sun Wallet.

E.Sun executives did confirm to NFC Times that Visa provided marketing support for the HCE mobile payments service. They also noted that they were getting technical help from Visa for the HCE technology, including testing. They indicated that they could launch HCE faster with Visa than they could have with MasterCard, giving the bank a key first-mover advantage.

Weber Chen, director of emerging product for Visa based in Taiwan, when asked by NFC Times in December what Visa was providing to E.Sun, would say only that the network was offering “professional support” to get the technology ready.

When asked last week for confirmation of the Singaporean vendor working on the project, Aptus, and whether the vendor was hired because of price or certification considerations, Weber would only say that, “what E.Sun selected was really up to the bank, as long as the product is compliant with Visa’s requirements.”

Whichever vendor is supplying the HCE technology for the E.Sun Wallet, the bank did say it has not encountered any major technical problems since its launch.

The main problems experienced by users so far are seen in most NFC payments rollouts, either with HCE or secure elements.

In some cases, for example, users don’t know where the NFC antenna sweet spot is on their phones, so they might fail in their first attempts to tap to pay with the wallet. Or they may have to upgrade their Android operating system on their device before they can use the app.

© NFC Times and Forthwrite Media. NFC Times content is for individual use and cannot be copied or distributed without the express permission of the publisher.