Germany-based Giesecke & Devrient has announced it has won a contract to serve as trusted service manager for Australia’s Commonwealth Bank for the bank’s contactless-mobile payment rollout.

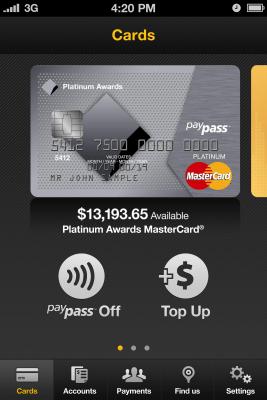

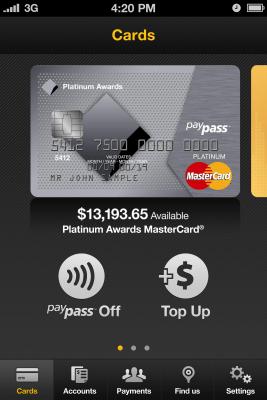

The service includes personalization and lifecycle management of payment applications on secure elements in NFC phones and other devices. That includes provisioning of MasterCard PayPass applications issued by the bank for attachments for the iPhone 4 and 4S, which the bank launched in December.

The iPhone sleeve, the iCarte, made by Canada-based Wireless Dynamics, comes with NFC and embedded secure chips, the latter storing the payment applications. Commonwealth Bank uses the device for its “Commbank Kaching” mobile-payment and banking app. The bank charges consumers A$49.95, plus $5 postage and handling (total US$58.62) for the attachment.