Visa Europe Moves Forward with Second iPhone Attachment

Visa Europe has announced a precommercial launch in Turkey and an internal trial in the United Kingdom of another iPhone attachment, the iCarte, which it hopes to introduce to enable consumers to tap their iPhones to pay where Visa payWave is accepted.

It’s the second so-called NFC “bridge” technology Visa has announced for iPhone users, following the announcement of certification by Visa Inc. in December of an attachment for the iPhone that works with contactless microSD cards. Visa also certified one smartphone model apiece made by Samsung and Research in Motion. RIM is the company behind the BlackBerry.

Visa Europe, U.S.-based Visa Inc.’s bank-owned European affiliate, hopes to eventually commercialize the iCarte, which is made by Canada-based Wireless Dynamics. But the card brand has not yet certified the attachment, which has apparently taken longer than expected. That type approval process for the iCarte is ongoing, a Visa Europe spokeswoman told NFC Times.

In October, NFC Times reported that Visa Europe would be trialing bridge technologies, including the iCarte, in such countries as Turkey and the United Kingdom, with a “view to commercializing” some of the products.

The card network demonstrated iCarte and the contactless microSD cards, which are made by U.S.-based DeviceFidelity, at the Cartes and Identification trade fair in December. It’s not clear whether Visa has an exclusive agreement to market the iCarte, as it does with DeviceFidelity’s In2Pay technology. Visa Europe is also planning to market the DeviceFidelity product.

"Visa recognizes that consumers who use smartphones like iPhone are more likely to be early adopters of advanced payment technology," Sandra Alzetta, senior vice president and head of innovation at Visa Europe, said in a statement. "Given that the availability of a wide range of mobile devices supporting contactless services remains a key hurdle for take-up, we are overcoming this by bringing the capability to the iPhones already in their pockets."

"Visa recognizes that consumers who use smartphones like iPhone are more likely to be early adopters of advanced payment technology," Sandra Alzetta, senior vice president and head of innovation at Visa Europe, said in a statement. "Given that the availability of a wide range of mobile devices supporting contactless services remains a key hurdle for take-up, we are overcoming this by bringing the capability to the iPhones already in their pockets."

Visa Europe hopes to get banks and mobile operators interested in the attachment in countries outside of the United Kingdom and Turkey, the two most developed contactless markets in Europe. That includes Poland and France. In Turkey, one of the largest banks, Yapi Kredi, and the country’s largest mobile operator, Turkcell, are involved in the iCarte precommercial launch.

Wireless Dynamics recently introduced an iCarte version for the iPhone 4. It had provided one for the previous two iPhone models. The attachment carries a full NFC chip along with a secure element, both from Netherlands-based NXP Semiconductors. It means the iCarte could be used to read tags and, possibly, conduct peer-to-peer communication. But Visa and its bank clients are mainly interested in card emulation–that is, enabling consumers to use the iPhone like a contactless card, but with a user-friendly iPhone app interface.

European consumers would not need to enter a PIN code when they tap to pay with the iCarte, though Visa said that as a security measure users must enter a PIN code on the iPhone keypad after a certain number of contactless transactions. Entering a PIN on a relatively insecure handset keypad may be one of the sticking points holding up certification. Cardholders enter PINs on more secure point-of-sale terminal keypads to reset transaction counters for contactless EMV cards.

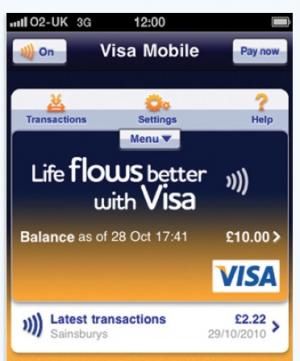

In Turkey, Yapi Kredi and Turkcell said they will make the iCarte attachment available at bank branches and telco shops, preloaded with the Visa payWave application. But for the first phase, the bank will send users the iCarte preloaded and personalized. Users will attach it to their iPhones and download the Visa Mobile for iCarte App from Apple’s App Store. They would then be able to tap their iPhones to pay at about 40,000 contactless point-of-sale terminals in Turkey, mostly in Istanbul.

The product, however, has not yet been commercialized in Turkey. The bank and telco will be selecting customers to participate in the precommercial launch. They would then apparently make it available to a wider customer base.

Turkey’s PR Wars

It is hard to gauge the timetable for rollouts of new payment technologies in Turkey, since players in this competitive market often make announcements they are hard-pressed to follow-up on in a timely manner.

For example, Turkcell’s announcement today characterized the iCarte as a commercial “deployment” in Turkey, an overstatement. Earlier, Turkcell had pledged to launch a rollout of full NFC phones before the end of 2010, a deadline it did not meet.

That pledge was apparently prompted by an announcement last May by Turkey’s Garanti Bank and mobile operator Avea to commercially launch contactless-mobile payment using SIM overlay chips with flexible antennas. Users would be able to pay with a MasterCard PayPass application.

The Garanti-Avea launch itself was at least five months late, however. The parties say they hope to sell at least 100,000 of the devices, which are supplied by France-based Gemalto. But MasterCard has not yet certified the devices–or any bridge technology for that matter–beyond passive contactless stickers.

Although Turkcell, which has held at least two full NFC phone trials, earlier appeared to balk at supporting a contactless-mobile project not involving applications stored on its SIM cards, it apparently sees the iCarte as a way to get moving on contactless-mobile payment in Turkey with a high-profile service. Update: A Turkcell spokeswoman told NFC Times the telco is planning to launch full NFC in 2011. End update.

"We're pleased to be Europe's first operator offering a commercial mobile contactless-payment solution for iPhone users," Cenk Bayrakdar, Turkcell’s chief product and services management officer, said in a statement.

Visa said the iCarte is also being trialed by Visa staffers in London, along with its partners on the project, FIS, a provider of prepaid platforms, and the Coventry Building Society.

Besides Turkey and the United Kingdom, as well as Poland and France, among other countries in which Visa hopes to interest its client banks in the attachment are Italy, Spain and Switzerland. Those countries have started to introduce contactless payment, including payWave.

Wireless Dynamics announced the iCarte around the time of the Cartes 2009 show. But the device had been delayed as the technology company waited for certification from Apple, likely needed for public trials to begin.