Intuit Develops NFC App for M-Payment Service on Android Phones

U.S.-based Intuit is demonstrating an NFC mobile-payment application for Android NFC phones that it says could enable small merchants to accept credit card payments with a tap of their phones on the NFC phones of customers.

The company is showing the application, which Intuit acknowledges is still in the “concept phase,” at the Google I/O 2011 developer conference being held today and tomorrow in San Francisco. Intuit spokeswoman Sharna Brockett told NFC Times the company plans to introduce the NFC application in the “near future.”

If the company, in fact, brings it to market, the NFC app would expand Intuit’s GoPayment credit card processing application for smartphones, which now uses a magnetic-stripe reader attached to the phones.

Fitting smartphones with swipe readers to enable small merchants or individuals to accept card payment is a growing business, and Intuit appears to be the first company that offers the service that has demonstrated its use with full NFC phones.

Major competitors in this small but growing market, Square and VeriFone, are not believed to have adapted their smartphone m-payment services to work with NFC.

But U.S.-based Square's chief operating officer, Keith Rabois, has reportedly said that “if NFC does become popular, we can bake it into our product.”

VeriFone’s PAYware Mobile uses a sleeve for Apple’s iPhone, which does not yet support NFC.

Intuit, which is mainly known for its accounting and tax software programs, such as Quicken and QuickBooks, for consumers and small businesses, introduced GoPayment more than two years ago. It said the mobile-payment service processes more than $19 million worth of transactions per week. The application is available on iPhones, along with smartphones running the Android, BlackBerry and Windows Phone 7 operating systems.

According to recent reports, Square processed about $16 million worth of transactions per week during the first quarter of 2011, and the company reportedly forecasted that transaction value would triple in the second quarter.

Like Square, Intuit recently eliminated the additional 15-cent per transaction fee it had charged, in order to attract more small merchants or individuals. Both Square and Intuit continue to charge commissions for each transaction. For Intuit, that amounts to 2.7% of the transaction amount if the merchant swipes the customer's card through the attached reader and 3.7% if he keys in the card number on his phone. The latter operation is less secure.

Sign-ups of new merchants are growing at a rate of 700%, said Intuit’s Brockett, though she declined to specify the actual numbers of merchants.

With Intuit’s NFC app, the idea would be to enable consumers to pay for merchandise using “virtual” payment cards stored on their NFC phones, said the company. “To complete the purchase, the customer and small business owner would simply touch their phones together, eliminating the need to swipe a credit card,” said the company in an announcement today.

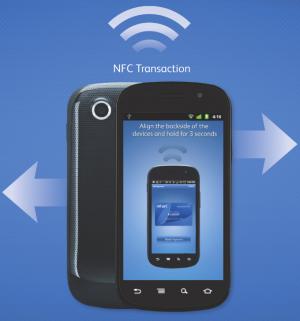

A demo the company released shows two people using the application by tapping their Google Nexus S NFC phones together to conduct a payment transaction.

After tapping, the customer is asked to approve the purchase by touching a button on her phone screen. Then the merchant taps a button on his screen to send the transaction over the mobile network for authorization.

He then signs the transaction on his phone screen, using his finger, and asks the customer if she wants a receipt. The merchant transmits the receipt to the customer by again tapping his phone on her phone. He also could send the receipt by text message.

Intuit said merchants could “scan” items for purchase or add products to store inventory by tapping them with their phones, as long as the products had NFC tags attached to them. Prices would have to come down for NFC product tagging to be economical, agreed Intuit’s Brockett.

Among questions yet to be answered would be how the NFC-enabled GoPayment application would handle security. It’s also unclear if the application uses NFC’s peer-to-peer mode when the merchant and customer tap their phones together, or if the merchant’s phone is acting as a reader and the customer’s phone is emulating a card. Google’s Android operating system does not yet support NFC card emulation, so it appears the application uses P2P mode.

In any case, the payment application, whether it supports Visa payWave, MasterCard PayPass or other contactless application, would undoubtedly have to be stored on secure chips in the phones. But Intuit’s Brockett said she did not know if the application in the demo used a secure chip in the Nexus S.

Secure chips aside, NFC is more secure than swipe transactions because the merchant never sees the customer’s card, she said.

“One of the advantages we see (with NFC) definitely is security,” she told NFC Times. “The transaction happens in the cloud and so actual credit card data or numbers, they’re not exposed in the transaction.”