Google has unveiled the much-anticipated revamp of its struggling Google Wallet–a cloud-based version that opens up the wallet to cards from all major U.S. payment brands, but which continues to use NFC to enable consumers to tap to pay and redeem offers in physical stores.

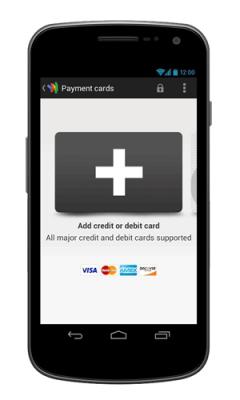

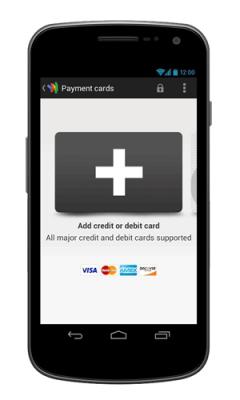

The new Google Wallet enables U.S. consumers to add their credit and debit cards supporting Visa, MasterCard, American Express and Discover Financial Services to do both in-store and online purchases.

The card accounts will be stored on Google's servers. But for the in-store purchases, Google will link these credit and debit card accounts to a virtual MasterCard card number stored on the secure element in NFC phones that support the wallet. Google calls this virtual card number the “Google Wallet ID.”

NFC TimesThe premier source for news, analysis and commentary on

NFC TimesThe premier source for news, analysis and commentary on