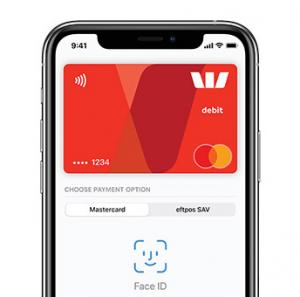

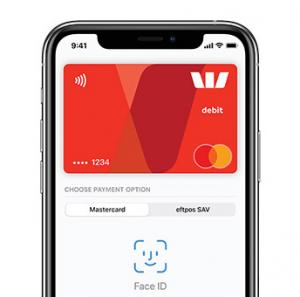

NFC TIMES Exclusive Insight – Citing the increased demand for cashless payments because of the Covid-19 pandemic, Westpac today became the last of Australia’s big four banks to adopt Apple Pay, ending a four-year holdout that had lasted months, even years longer than its major rivals.

While the move by Westpac to allow its cards to be loaded into Apple’s Wallet would have happened eventually, the bank is believed to have accelerated its adoption of Apple Pay after seeing that virus-wary consumers were keen to avoid using cash and even, in some cases, contactless cards. The latter require consumers to touch PIN pads at retail checkout counters to complete high-value transactions. Rival Commonwealth Bank of Australia earlier this month had disclosed that it saw a record AUD 1 billion (USD 650.6 million) in spending from digital wallets, including Apple Pay in March, and also recorded a record number of digital wallet transactions at 36 million. That includes online and in-app transactions, in addition to in-store payments.

Commonwealth Bank, which had ended its own boycott of Apple Pay in early 2019, also participates in Google Pay, Samsung Pay and two wallets from wearables makers, Garmin Pay and Fitbit Pay. But Apple Pay likely accounts for the most transactions of any digital wallet the bank’s customers use.

NFC TimesThe premier source for news, analysis and commentary on

NFC TimesThe premier source for news, analysis and commentary on